After Illinois’ Own Audit Delays, Local Governments Follow Suit

A Crisis of Fiduciary Neglect Spreads Across the State

Earlier, City NewsWire and others reported that the State of Illinois was nearly two years late completing its annual audit.

Now, local governments appear to be following the state’s lead. Across Cook, DuPage, and Lake Counties, municipalities and special districts are increasingly delinquent in filing their own required reports with the Illinois Comptroller’s Office, leaving taxpayers and watchdogs in the dark.

Local Governments Falling Behind

The Comptroller’s latest delinquency report shows a wave of missed and unapproved filings, suggesting that fiscal accountability in Illinois has become contagious.

Cook County

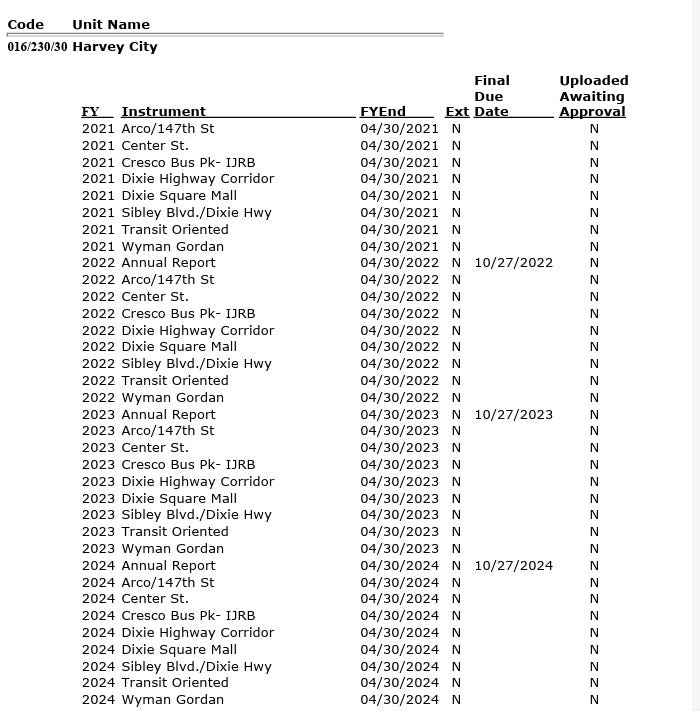

Harvey City — Behind on multiple TIF reports (Arco/147th St, Dixie Highway Corridor, Center Street, and others) and late on its 2024 Annual Report, continuing a pattern of repeated delays across several redevelopment districts.

Dolton Village — Failing to submit required TIF and Annual Reports despite ongoing fiscal distress and state scrutiny.

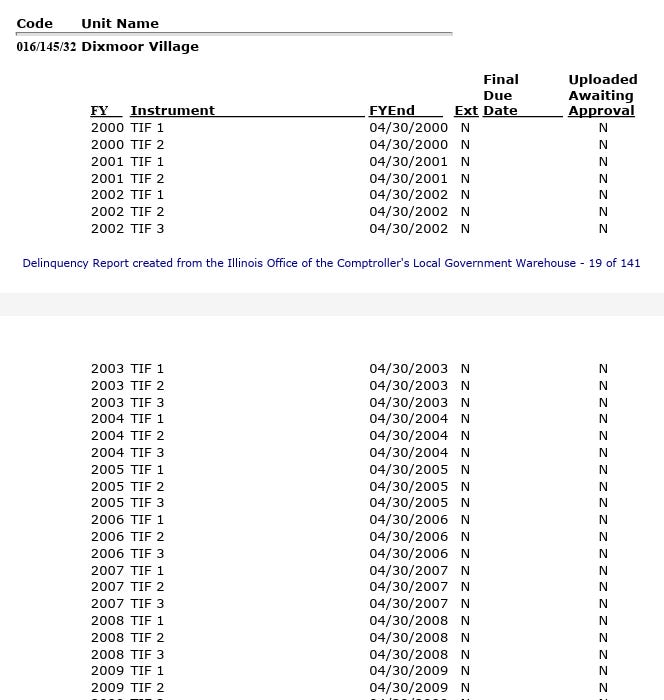

Dixmoor Village — No approved TIF filings since the early 2000s, suggesting over two decades of unverified redevelopment accounting.

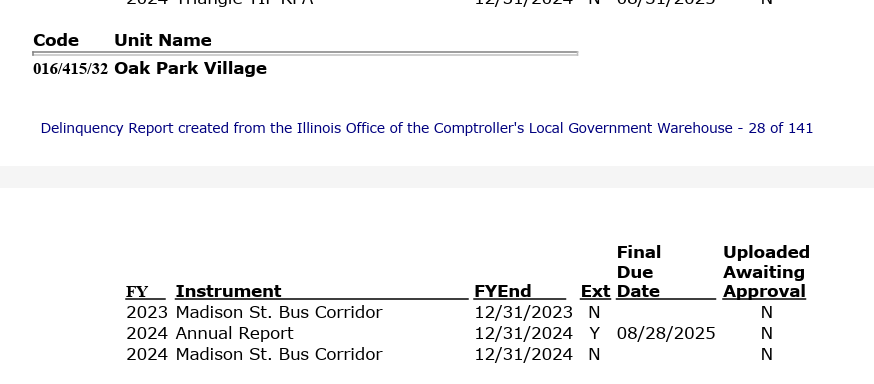

Oak Park Village — Late on its 2024 Annual Report and unfiled Madison Street Bus Corridor TIF reports, a rare lapse for one of Cook County’s most affluent municipalities.

Bellwood, Berwyn, and Alsip — Each with pending or unapproved filings, reflecting the same complacency spreading across the county’s inner suburbs.

Even modest-sized communities lag months behind on basic transparency requirements, leaving residents unable to see how local tax dollars are spent.

DuPage County

Bensenville Village — The standout offender, with six delinquent TIF districts

(Grand Ave #4, Grand/York #11, Heritage Square #5, Irving Park/Church Rd #7, North Industrial, Route 83 & Thorndale #6) and a missing FY 2024 Annual Report.

Roselle #1 Fire Protection District — Late FY 2024 Annual Report.

Villa Park Village — Late FY 2024 Annual Report.

Each missing report obscures millions in redirected property-tax revenue meant for redevelopment, schools, and fire protection.

Lake County

Del Mar Woods Sanitary District — The most persistent offender, with six consecutive unapproved reports (2019–2024), leaving residents without verified financials for essential sewer and water operations.

Highwood City — Delinquent on both its FY 2024 Annual Report and Downtown Highwood TIF filing, continuing a two-year lapse in fiscal transparency.

Deerfield Village — Missing TIF reports for 2023 and 2024 in its Downtown Village Center district, a prime retail corridor where reinvestment transparency is critical

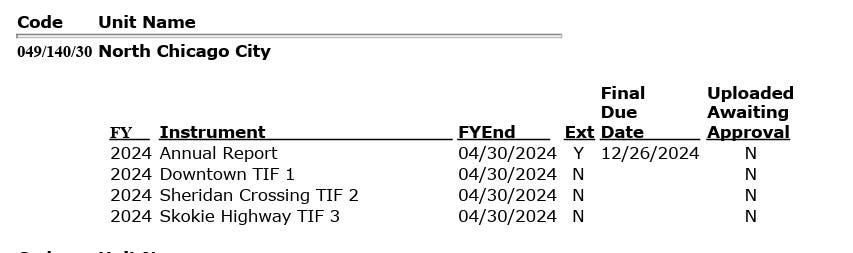

North Chicago City — Once under state oversight, now again delinquent on its FY 2024 Annual Report and three TIF districts (Downtown, Sheridan Crossing, Skokie Highway).

.

Riverwoods Village — Failed to file TIF reports for both 2024 redevelopment areas on Deerfield Road and Milwaukee/Deerfield Road.

Round Lake Park Village — Missing Annual Reports for 2023 and 2024.

Waukegan City — One of the largest governments on the list, delinquent on four TIF districts (North Lakefront, Downtown Lakefront, South Lakefront, McGaw Business Center) for both 2023 and 2024.

Winthrop Harbor Village — Behind on 2023 and 2024 filings for the Sheridan Road TIF and Annual Report.

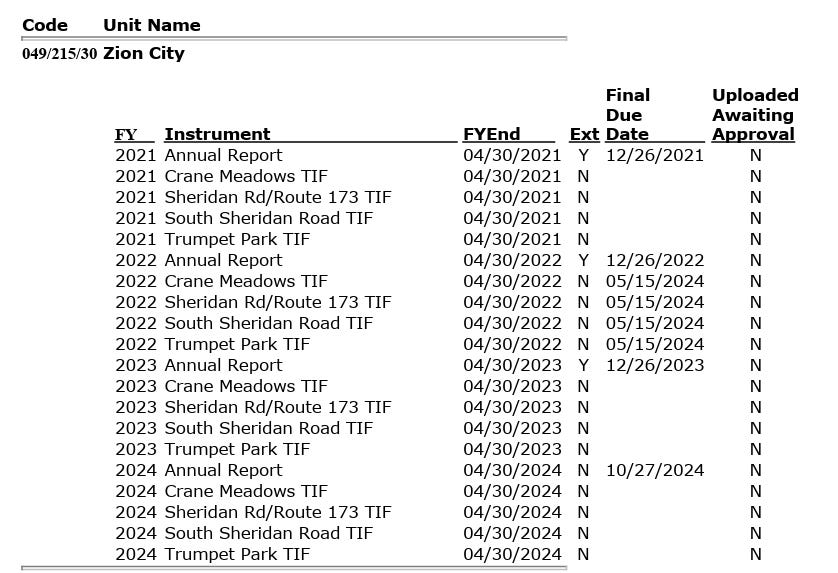

Zion City — A chronic violator, missing Annual Reports dating back to 2021 and multiple unfiled TIF reports across its Crane Meadows, Sheridan Rd/Route 173, South Sheridan Rd, and Trumpet Park districts.

A Culture of Delay

Whether it’s Harvey and Dolton in the south suburbs, Bensenville in DuPage, or Waukegan and Zion on the lakefront, Illinois governments are falling into the same pattern: missing filings, ignoring deadlines, and eroding the public’s ability to track how taxpayer money is used.

The issue is no longer isolated or clerical — it’s cultural. The state’s own audit delays set the tone, and local governments are simply following the example.

Transparency failures at this scale don’t happen by accident; they signal a collapse of fiduciary oversight where boards and administrators stop fearing accountability because no one enforces it.

From the Statehouse Down: A Culture of Delay

The State of Illinois’ own two-year-late audit set the tone. When Springfield ignores its statutory deadlines, it tells every local government that deadlines no longer matter.

That example has normalized negligence. If the state can shrug off fiduciary duty, why wouldn’t smaller governments assume the same leniency?

Fiduciary Duty: The Forgotten Promise

Elected officials and administrators hold a fiduciary duty to manage public funds honestly, prudently, and transparently. Delinquent reporting violates that trust as surely as misuse of funds.

When governments fail to file:

The Comptroller cannot certify solvency.

Auditors cannot detect fraud or waste.

Residents cannot know how their money is spent.

Late reports don’t merely reflect disorganization — they obscure accountability.

The Bottom Line

Illinois’ transparency crisis now stretches from Springfield to its smallest suburbs.

Public money requires public accountability. And in Illinois, even that basic principle is arriving past deadline.